29 July 2019

|

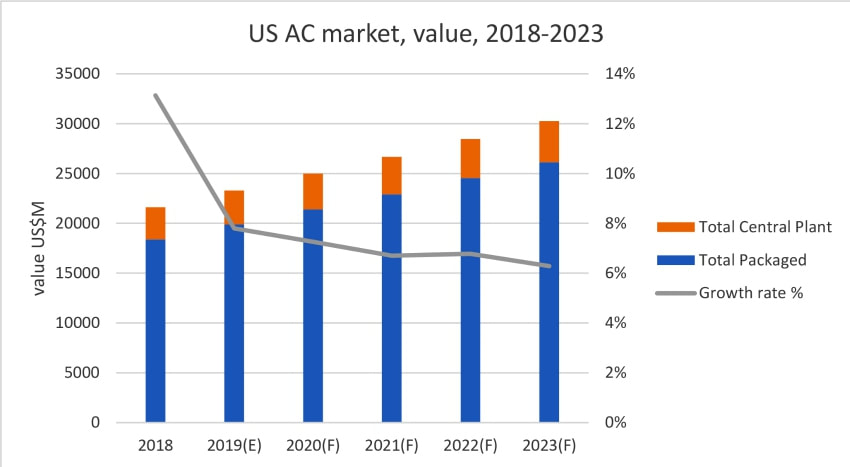

| BSRIA research indicates that the value of the US market for packaged air conditioning rose by more than 14% in 2018 to reach US$ 20.4 billion, while the central plant sector grew by around 6% to US$3.2bn. The newly-published market survey, Room, packaged, unitary and furnaces air conditioning study, includes the combined sales for windows/through the wall units, PTAC, moveables, minisplits, VRF, rooftops, indoor packaged, US-style ducted splits, evaporative coils (including those with blower), furnaces and close control units. |

The packaged market’s growth saw an increase of more than 6% in volumes, although prices increased above this level, driven by warm weather and a relatively healthy US economy and the residential sector benefitted from continued consumer confidence.

BSRIA estimates that 2019 will see further growth of just under 4% in terms of volume but over 8% in terms of value, to exceed US$ 22bn this year. VRF will continue to see strong growth and although small compared to the overall AC sales it continues to be the 4th largest VRF market in the world., albeit still from a low base, while mini splits will again grow in double digits. In contrast PTAC are forecast to decline in volume, but is still set to reach USD 379 million by 2023.

US style ducted splits still dominate, but growth is modest at around 3%, whilst the minisplits market remains small at less than 10% of the US ducted splits market in terms of volume, but still expected to see double digit growth.

The rooftop market is relatively mature and is expected to see modest volume growth with a CAGR to 2023 of less than 3%. Nevertheless, the US still account for 90% of rooftops sold in the world.

Efficiency, greener products, smart revolution and convergence of technologies have been the main drivers in the air conditioning market in the USA in the past five years.

With US average electricity prices less than half the European average, saving money on energy bills has not been a high priority for US consumers except in selected States such as California and the North East. The relatively long payback period for more energy efficient AC systems is a disincentive for consumers, for whom “smarter” features such as connected access and voice control can be more appealing. However, the commercial AC market appears to be more responsive to energy savings.

Central plant

Meanwhile, the central plant figures include the combined sales for chillers and airside (AHUs, fan coils, VAVs and other terminal units) products.

The chiller market expanded very modestly in 2018. Sales were propelled by higher efficiency systems, the use of new refrigerants and addons from suppliers, such as remote monitoring based on subscriptions, as a tool to retain customers and to store useful data on patterns of equipment utilization. Often, efficiency of old systems is improved by retrofitting a variable speed drive rather than purchasing a new unit. In terms of volume, sales are expected to remain fairly flat. Under a scenario of sluggish equipment sales, service represents a good opportunity to increase profitability and to retain customers until the next sales cycle.

Air handling units (AHUs) will follow suit, says BSRIA, moving towards increasing fan motor efficiency, more controls and features to improve indoor air quality.

With regard to the fan coil market, this will remain highly commoditised, although BSRIA expects to see some innovation in fan motor efficiency. This market was less affected by inflationary pressures due to the fact of a large base of local manufacturers. Energy efficiency through the use of EC fan motors and noise reduction are the main trends, together with improvements in design to allow for easier installations.

The BSRIA report on air conditioning analyses the main trends underlying the US market with a deep dive into the demand evolution by product, segment, capacity, application and key components. Special focus is on the emergence of ductless in residential and light commercial, energy efficiency regulation and market forces, refrigerants, a fast-changing competitive landscape and outlook for the market within the next five years. With a combination of detailed market data and insightful analysis, the US AC BSRIA report is a unique tool for strategy planning available to all the businesses operating or planning to operate in this exiting market.

www.bsria.co.uk

BSRIA estimates that 2019 will see further growth of just under 4% in terms of volume but over 8% in terms of value, to exceed US$ 22bn this year. VRF will continue to see strong growth and although small compared to the overall AC sales it continues to be the 4th largest VRF market in the world., albeit still from a low base, while mini splits will again grow in double digits. In contrast PTAC are forecast to decline in volume, but is still set to reach USD 379 million by 2023.

US style ducted splits still dominate, but growth is modest at around 3%, whilst the minisplits market remains small at less than 10% of the US ducted splits market in terms of volume, but still expected to see double digit growth.

The rooftop market is relatively mature and is expected to see modest volume growth with a CAGR to 2023 of less than 3%. Nevertheless, the US still account for 90% of rooftops sold in the world.

Efficiency, greener products, smart revolution and convergence of technologies have been the main drivers in the air conditioning market in the USA in the past five years.

With US average electricity prices less than half the European average, saving money on energy bills has not been a high priority for US consumers except in selected States such as California and the North East. The relatively long payback period for more energy efficient AC systems is a disincentive for consumers, for whom “smarter” features such as connected access and voice control can be more appealing. However, the commercial AC market appears to be more responsive to energy savings.

Central plant

Meanwhile, the central plant figures include the combined sales for chillers and airside (AHUs, fan coils, VAVs and other terminal units) products.

The chiller market expanded very modestly in 2018. Sales were propelled by higher efficiency systems, the use of new refrigerants and addons from suppliers, such as remote monitoring based on subscriptions, as a tool to retain customers and to store useful data on patterns of equipment utilization. Often, efficiency of old systems is improved by retrofitting a variable speed drive rather than purchasing a new unit. In terms of volume, sales are expected to remain fairly flat. Under a scenario of sluggish equipment sales, service represents a good opportunity to increase profitability and to retain customers until the next sales cycle.

Air handling units (AHUs) will follow suit, says BSRIA, moving towards increasing fan motor efficiency, more controls and features to improve indoor air quality.

With regard to the fan coil market, this will remain highly commoditised, although BSRIA expects to see some innovation in fan motor efficiency. This market was less affected by inflationary pressures due to the fact of a large base of local manufacturers. Energy efficiency through the use of EC fan motors and noise reduction are the main trends, together with improvements in design to allow for easier installations.

The BSRIA report on air conditioning analyses the main trends underlying the US market with a deep dive into the demand evolution by product, segment, capacity, application and key components. Special focus is on the emergence of ductless in residential and light commercial, energy efficiency regulation and market forces, refrigerants, a fast-changing competitive landscape and outlook for the market within the next five years. With a combination of detailed market data and insightful analysis, the US AC BSRIA report is a unique tool for strategy planning available to all the businesses operating or planning to operate in this exiting market.

www.bsria.co.uk

Content continues after advertisements